Exactly How Does Afterpay Affect Credit Score? Crucial Factors To Consider for Customers

Reviewing Whether Afterpay Usage Can Impact Your Credit History

As the appeal of Afterpay continues to increase, numerous people are left questioning concerning the possible influence this solution might have on their credit score ratings. The correlation in between Afterpay use and credit score ratings is a subject of interest for those aiming to keep or improve their financial health.

Recognizing Afterpay's Influence on Credit report

The utilization of Afterpay can influence individuals' credit rating scores, motivating a requirement for an in-depth comprehension of its impact. Afterpay, a prominent "get now, pay later on" solution, allows consumers to divide their purchases into smaller installation settlements. While Afterpay does not perform credit history checks when consumers at first sign up, late or missed out on settlements can still affect credit rating. When a client misses a repayment, Afterpay might report this to credit rating bureaus, leading to an unfavorable mark on the person's credit rating record. It is important for customers to comprehend that while Afterpay itself does not naturally damage credit rating, reckless use can have effects. Keeping an eye on settlement due dates, keeping an excellent repayment background, and making sure all installations are paid promptly are essential steps in guarding one's credit history score when utilizing Afterpay. By understanding these nuances, individuals can take advantage of Afterpay sensibly while reducing any type of prospective negative impacts on their credit report.

Factors That Impact Credit Report Adjustments

Recognizing Afterpay's influence on credit report discloses a direct link to the numerous variables that can significantly affect modifications in a person's credit history gradually. One important variable is payment history, representing concerning 35% of a credit history. Making on-time repayments continually, consisting of those for Afterpay purchases, can positively affect the credit rating. Credit scores use, which makes up around 30% of the score, is one more essential variable. Making use of Afterpay sensibly without maxing out the offered credit history can aid preserve a healthy credit scores use ratio. The size of credit report, adding around 15% to ball game, is also essential. Using Afterpay over an extended period can positively affect this element. Additionally, brand-new credit score questions and the mix of credit accounts can affect credit report. does afterpay affect credit score. Although Afterpay may not straight affect these aspects, understanding their importance can aid individuals make informed decisions to keep or enhance their credit history while making use of solutions like Afterpay.

Monitoring Credit History Modifications With Afterpay

Keeping track of credit rating modifications with Afterpay includes tracking the impact of repayment practices and credit report utilization on overall credit health. By utilizing Afterpay properly, individuals can maintain or enhance their credit rating. Prompt payments are essential, as missed out on or late repayments can negatively influence credit history ratings. Keeping an eye on settlement due dates and making sure adequate funds are readily available to cover Afterpay installations can assist avoid any type of negative effect on credit history ratings. In addition, keeping credit scores application reduced is important. Making use of Afterpay for small, manageable purchases and maintaining bank card equilibriums see here low loved one to credit history restrictions demonstrates liable credit habits and can positively influence credit history scores. On a regular basis evaluating credit report records to look for any disparities or errors connected to Afterpay deals is additionally suggested. By staying watchful and proactive in checking settlement routines and credit report use, people can efficiently handle their credit history while utilizing Afterpay as a repayment alternative.

Tips to Take Care Of Afterpay Properly

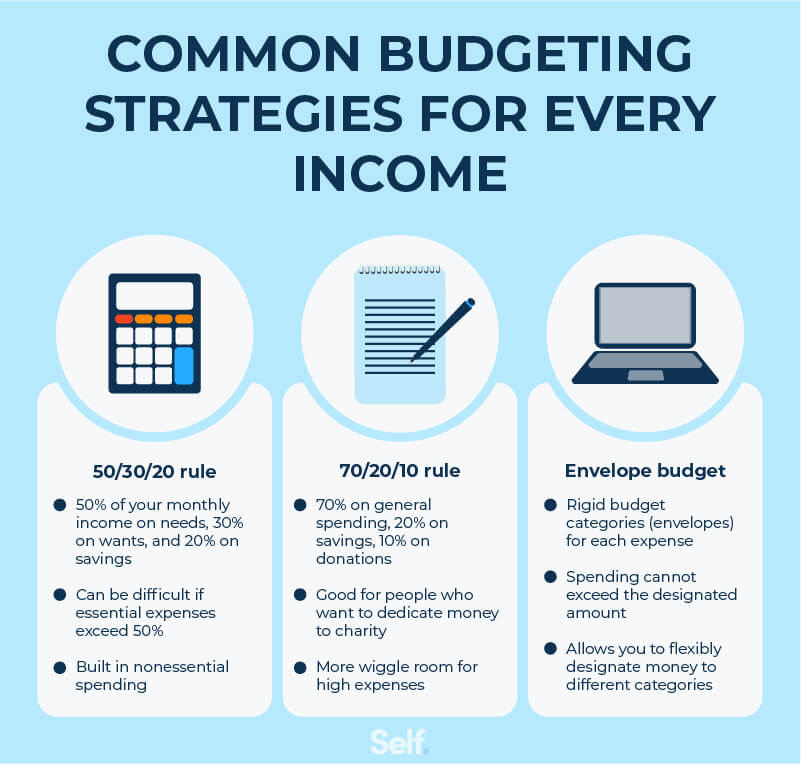

To browse Afterpay responsibly and maintain a healthy and balanced credit report, individuals can apply effective techniques useful site to handle their monetary commitments wisely. Firstly, it is crucial to develop a budget plan detailing earnings and expenses to ensure affordability before dedicating to Afterpay acquisitions. This technique aids avoid overspending and accumulating debt beyond one's means. Secondly, utilizing Afterpay precisely for vital items instead of indulgent acquisitions can aid in preserving economic security. Focusing on settlements for requirements can avoid unnecessary financial strain and promote liable investing habits. Furthermore, keeping track of Afterpay payment routines and making sure timely repayments can aid stay clear of late charges and unfavorable effects on credit history. On a regular basis monitoring Afterpay transactions and total economic wellness with budgeting apps or spread sheets can give useful understandings right into investing patterns and help in making informed monetary decisions. By adhering to these ideas, individuals can utilize Afterpay responsibly while safeguarding their credit rating score and monetary well-being.

Verdict: Afterpay's Duty in Credit history Health And Wellness

In evaluating Afterpay's effect on credit report health and wellness, it ends up being evident that prudent financial management remains vital for people using this solution. While Afterpay itself does not straight influence credit history, overlooking payments can lead to late fees and debt accumulation, which could indirectly affect creditworthiness - does afterpay affect credit score. It is vital for Afterpay individuals to budget plan successfully and guarantee timely repayments to copyright a favorable credit rating standing

Moreover, understanding exactly how Afterpay incorporates with individual money behaviors is necessary. By utilizing Afterpay properly, individuals can enjoy the ease of staggered repayments without endangering their credit history health and wellness. Keeping an eye on costs, evaluating price, and remaining within budget are basic methods to stop economic stress and potential credit scores rating ramifications.

Conclusion

Comprehending Afterpay's influence on credit rating scores exposes a straight web link to the numerous variables that can significantly influence modifications in an individual's credit report rating over time. In addition, new credit report questions and the mix of credit accounts can influence credit rating scores.Keeping track of credit history rating modifications with Afterpay includes tracking the effect of payment practices and credit history application on general credit score health and wellness - does afterpay affect credit score. Utilizing Afterpay for tiny, workable acquisitions and maintaining credit scores card equilibriums reduced relative to credit rating limits demonstrates liable credit actions and can favorably influence credit rating ratings. By remaining proactive and cautious in keeping an eye on repayment habits and credit score use, individuals can properly manage their credit rating rating while utilizing Afterpay as a payment choice